Medicare is a health insurance program administered by the federal government. This program is meant to serve Americans ages 65 or older, younger people who have disabilities, and people who have certain illnesses.

Why Is Medicare Important?

Like any type of insurance, health insurance helps an individual minimize financial loss in case of illness or disability. Having no health insurance means paying for treatments, consultations, medicine, or rehabilitation from your pocket.

According to the We Speak Medicare team at Boomer Benefits, signing up for a Medicare program means creating a buffer for when you reach your golden years. But with the various options available, choosing which plan to get can be problematic.

If you’re still confused on how to choose the right Medicare plan for you, here are seven basic considerations before signing up:

1. Eligibility

Having Medicare isn’t a requirement, but the substantial amount of money you save when you have health care is worth considering. A person is eligible to sign up for Medicare is if the following applies:

- Must be 65 years old and above

- A legal permanent US resident for a minimum of five continuous years

- Have amyotrophic lateral sclerosis (ALS) or end-stage renal disease (ESRD)

- Below 65 years old but entitled to Social Security disability benefits

If you want to get into the free Medicare Part A program, a total of 40 calendar quarters must have been paid to you or your spouse’s Social Security taxes or the Rail Road Board while still employed.

2. Cost Of Premium

Like mentioned earlier, having no Medicare enforced is costlier than paying for premiums. However, the cost of premiums will depend on which program you’re enrolled in.

If you’re approaching your golden years and shopping for health care options, it’s essential to do one more round of estate planning before signing up for a Medicare plan. Having control over how much to allocate for health insurance is also a vital part of making sure you don’t end up going bankrupt.

3. Coverage

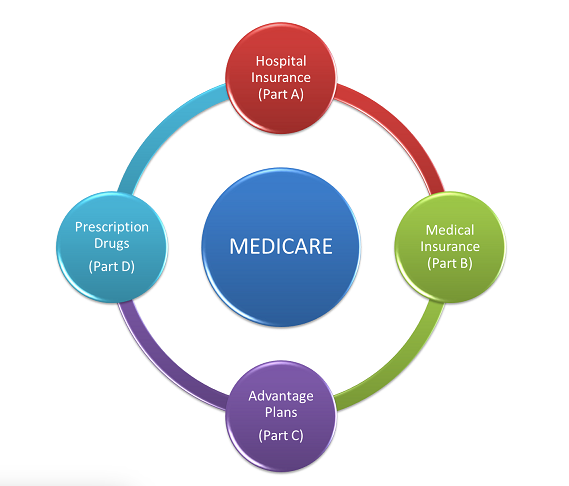

Not all Medicare plans have the same components. You’ll need to study Medicare Parts A to D, Medicare Advantage, and Medigap to ensure you join a program that fits your budget and living arrangement.

The two basic Medicare programs are Original Medicare and Medicare Advantage—health insurance you can get from private companies. Original Medicare is the combination of Parts A and B while Medicare Advantage goes beyond everything under Original Medicare plus additional features, including dental consultations and treatment.

4. Hospital And Doctors Network

As mentioned above, Medicare plans don’t have similar benefits. Part of what you should look into is the network of hospitals and doctors that accept the Medicare plan you bought. Original Medicare gives you access to any doctor and hospital while Medicare Advantage is only accepted by health providers who are part of your plan’s network.

5. Prescription Drugs

If you’re worried about the medications you need to take and how much impact they’ll have on your wallet, you should check out Medicare Part D, known as the prescribed drugs’ benefits. If you intend to sign up for Original Medicare, know that this insurance doesn’t cover prescription drugs. Meanwhile, Medical Advantage insurances include this benefit in their programs.

6. Travel Habits Or Routine

You also need to consider your travel habits and routine before deciding on which Medicare program to join. Traveling around the country isn’t challenging since your coverage is still enforced inside the US. The problem arises when you go outside the US.

Travel coverage outside the US doesn’t exist in the Original Medicare program, and the same goes for Medical Advantage. If you travel frequently, you need to supplement your health protection to ensure you get quality care during emergencies while traveling outside the country.

7. Quality Of Care

Finally, another consideration is quality of care. If you’ve already had an experience with the affiliated doctors, hospitals, or home care facilities, ask yourself if you’re satisfied with the quality of care you received. Taking this into consideration should help you decide if you’ll stay with your plan provider, switch to another one, or supplement what you already have.

Conclusion

Your health is one of the things you should prioritize whether you’re entering your golden years or just about to turn 40. Signing up for health insurance shouldn’t be a daunting task.

To take the load off and help you narrow down your options, make sure you always consider which program you’re eligible to join, how much premium you need to pay every year, what kind of coverage you require, the ease of seeing your preferred health care provider, the quality of care you get, and how all of these will fit your lifestyle.