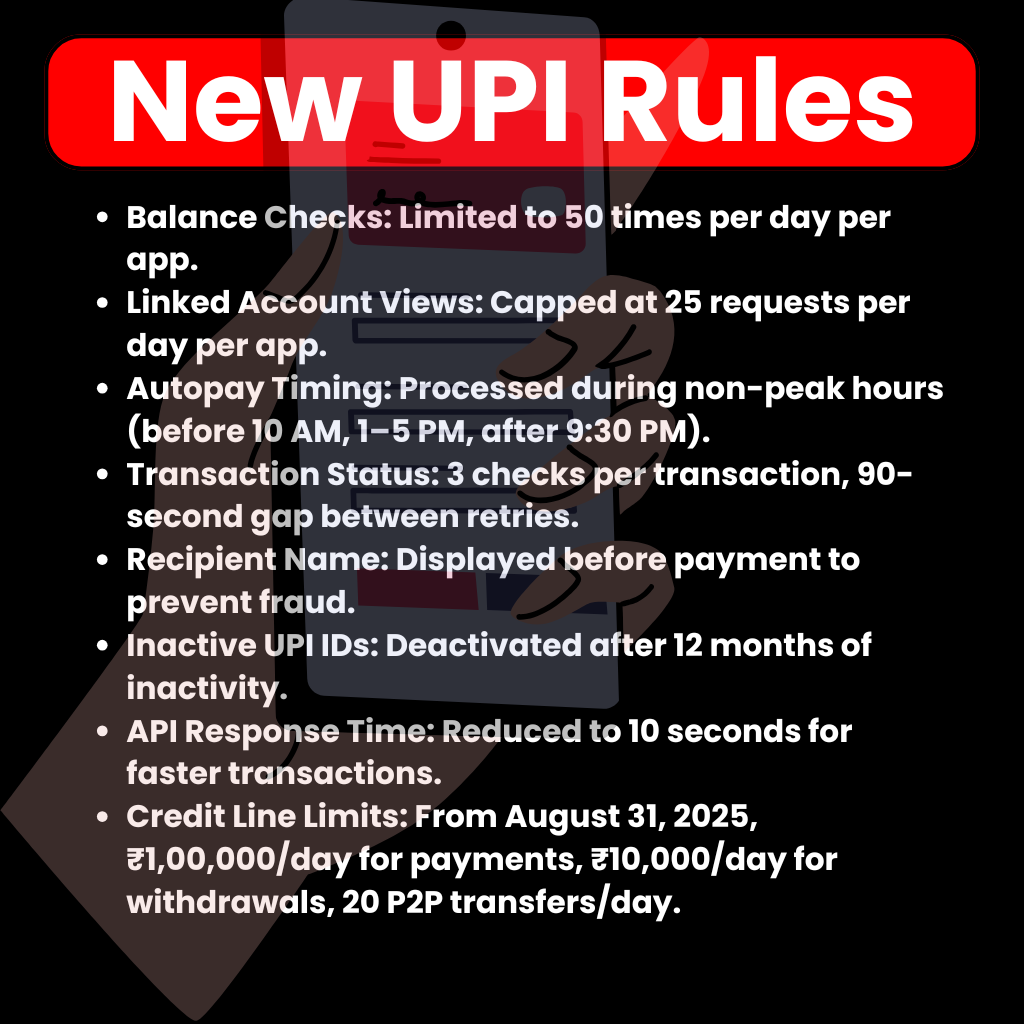

The new UPI guidelines, which go into effect on August 1, 2025, bring substantial improvements to India’s digital environment, improving payment efficiency and security. The NPCI introduced these modifications, which include balance check restrictions (50 per day per app) and autopay scheduling during off-peak hours to decrease system pressure. SBI credit card members will no longer receive gratis aviation accident insurance on specific co-branded cards from August 11, 2025, affecting perks such as ₹50 lakh to ₹1 crore coverage, according to Business Standard and Hindustan Times.

New UPI Rules Point

- Research suggests new UPI rules from August 1, 2025, include limits on balance checks, autopay processing times, and enhanced security measures, effective as of today, August 2, 2025.

- It seems likely that these changes aim to improve system efficiency and reduce fraud, with some rules like credit line limits starting August 31, 2025.

- The evidence leans toward these rules impacting heavy users more, with daily caps on balance checks (50 times) and linked account views (25 times).

Unified Payments Interface (UPI) Overview 2025

The Unified Payments Interface (UPI) in India has implemented new regulations that will take effect on August 1, 2025, to improve both performance and security. The National Payments Corporation of India (NPCI) has made modifications that will effect how consumers interact with UPI applications such as Google Pay, PhonePe, and Paytm. The important modifications are listed below, and they are intended to make the payment experience smoother and more dependable.

Key Changes

Balance and Account Limits: To alleviate system burden, users can now check their balance up to 50 times per app and access connected bank accounts up to 25 times per day.

Autopay Scheduling: To reduce congestion, autopay transactions such as EMIs and subscriptions are performed during non-peak hours (before 10 a.m., 1 pm to 5 p.m., and after 9:30 p.m.

Security Enhancements: New safeguards include showing recipient names before payments, tougher account verification, and automatic deactivation of inactive UPI IDs after one year.

Future Updates 2025

Beginning August 31, 2025, UPI credit lines will have daily restrictions for payments up to ₹1,00,000, cash withdrawals up to ₹10,000, and P2P transfers up to 20 times.

Detailed Rule Changes Today UPI:-

| Rule | Details | Effective Date |

|---|---|---|

| Balance Enquiry Limits | Maximum 50 manual checks per app per day, no background checks allowed | August 1, 2025 |

| Linked Bank Account Views | Maximum 25 requests per user per app per day to list linked accounts | August 1, 2025 |

| Autopay Processing Hours | Processed during non-peak hours: before 10 AM, 1 PM to 5 PM, after 9:30 PM | August 1, 2025 |

| Failed Transaction Status Checks | Maximum 3 attempts, with a 90-second wait between retries | August 1, 2025 |

| GST on UPI Transactions | No GST applicable, even for payments over ₹2,000; merchants may have charges | August 1, 2025 |

| Recipient Name Display | Recipient’s registered name shown before payment confirmation | August 1, 2025 |

| Inactive UPI ID Deactivation | Auto-disabled if tied to inactive mobile number >12 months | August 1, 2025 |

| Stricter Bank Account Verification | Enhanced authentication and validation for new accounts | August 1, 2025 |

| Reduced API Response Time | Core APIs must respond within 10 seconds (previously 30 seconds) | August 1, 2025 |

| UPI Through Credit Lines | Payments ₹1,00,000/day, cash withdrawals ₹10,000/day, 20 P2P transfers/day | August 31, 2025 |

SBI Credit Card Updates With UPI

From August 11, 2025, SBI Card will discontinue complimentary air accident insurance on several co-branded credit cards, such as SBI Card Elite and SBI Card Prime. This means cardholders will lose insurance coverage ranging from ₹50 lakh to ₹1 crore, previously offered on cards partnered with banks like UCO Bank and Central Bank of India.

UPI Rule Changes

The National Payments Corporation of India (NPCI) has introduced several updates effective from August 1, 2025, to manage system load and enhance user experience. Key changes include:

- Limiting balance checks to 50 times per day per app to reduce system strain.

- Scheduling autopay transactions (like EMIs and subscriptions) during non-peak hours (before 10 AM, 1 PM to 5 PM, and after 9:30 PM) to avoid congestion.

- Displaying the recipient’s registered name before confirming payments to prevent fraud.

Conclusion

The new UPI regulations, starting August 1, 2025, mark a substantial step toward improving the system’s efficiency and security. Users are recommended to become acquainted with these changes, particularly the daily restrictions and autopay schedules, to guarantee smooth transactions. Additionally, SBI credit card customers should be aware that insurance benefits will be discontinued on August 11, 2025, and they should investigate alternate solutions. For more information, consult the references provided.